Now Reading: What do you call an iBuyer that isn’t iBuying houses?

-

01

What do you call an iBuyer that isn’t iBuying houses?

What do you call an iBuyer that isn’t iBuying houses?

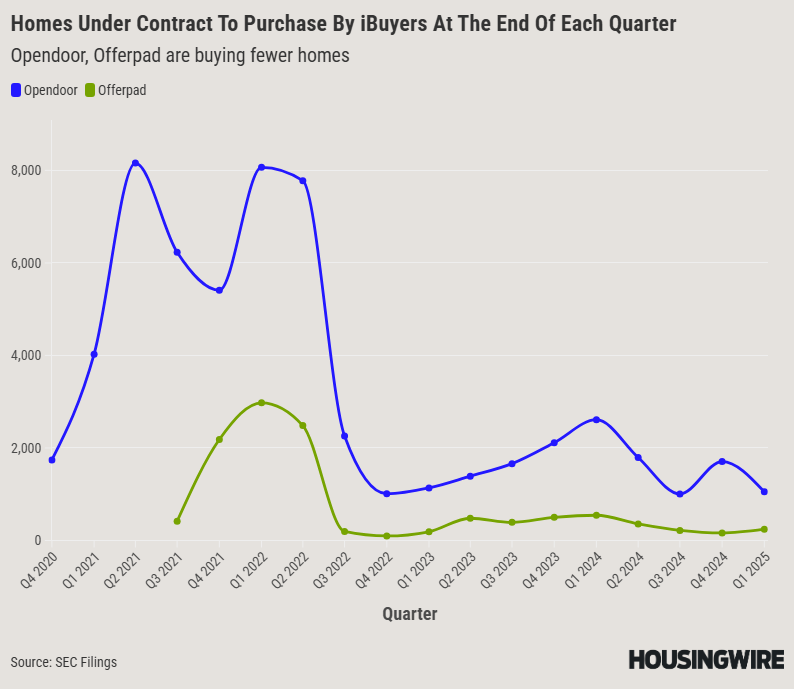

Opendoor and Offerpad, once seen as potential disruptors in the residential real estate industry, are now struggling to stay relevant. These companies, known as iBuyers, have not been able to consistently make a profit and are facing challenges due to macroeconomic conditions that have limited their ability to flip houses algorithmically.

Both Opendoor and Offerpad are now buying fewer homes than before, leading to difficulties in breaking even. With their stock prices hovering around $1, their futures are uncertain. The companies’ business model relies on high transaction volumes, which they are currently unable to achieve.

The iBuyers’ concept aimed to provide home sellers with a streamlined process for selling and buying homes simultaneously. However, this model is capital-intensive, operates on low margins, and requires high transaction volumes to be profitable. The companies depend on a stable housing market for accurate pricing and successful sales.

Despite initial interest and innovation in the iBuying concept, Opendoor and Offerpad are now facing significant challenges. Other major players in the real estate industry have also entered the iBuying space, but many have struggled to adapt to market changes, with some companies shutting down their iBuying programs due to losses.

To cope with declining revenue, Opendoor and Offerpad have downsized their operations and implemented cost-cutting measures, including layoffs. However, the companies are finding it difficult to reduce costs further without compromising their business operations.

As consumer sentiment remains uncertain and housing market conditions continue to fluctuate, the future of iBuyers like Opendoor and Offerpad remains uncertain. These companies are exploring new strategies and services to supplement their iBuying operations, but they must proceed carefully to avoid further losses.

In a challenging market environment, Opendoor and Offerpad are evaluating their options, including potential mergers or partnerships, to ensure their survival in the real estate industry. Despite their current struggles, the companies are seeking opportunities to create value and remain competitive in the market.