Now Reading: Warren Buffet talks economy, tariffs at annual Berkshire Hathaway shareholder meeting

-

01

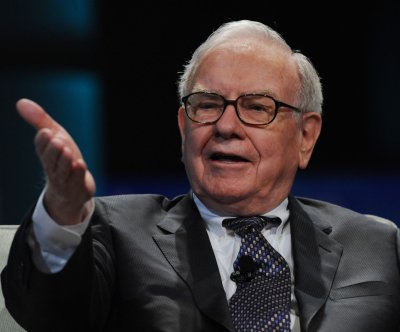

Warren Buffet talks economy, tariffs at annual Berkshire Hathaway shareholder meeting

Warren Buffet talks economy, tariffs at annual Berkshire Hathaway shareholder meeting

Warren Buffett expressed his views on a range of topics, including Donald Trump’s tariffs and the economy, during the Berkshire Hathaway annual shareholder weekend in Omaha, Nebraska. With 20,000 attendees, it was a record turnout for the event. Buffett, who has been at the helm of the company for 60 years, favors the equity market over large cash holdings. As the largest shareholder of Berkshire Hathaway, he holds about 31.2% of its voting interest. Known as the “Oracle of Omaha,” Buffett is the seventh wealthiest person in the world with a net worth of $168.2 billion. He believes the American economy will stabilize following market turbulence caused by Trump’s tariff announcements. Buffett emphasized the importance of trade and discouraged using tariffs as a form of aggression. The company’s market capitalization was $1.16 trillion. During the event, Buffett and Greg Abel, Berkshire Hathaway Energy Chair, addressed questions about the company’s insurance business and ongoing investments in coal power plants. Abel stated that they cannot be the insurer of last resort and highlighted the necessity of coal in maintaining stable power grids. They plan to collaborate with states to determine the future of energy production.