Now Reading: Top Connecticut Dem Jim Himes admits GOP SALT increase would ‘be good’ for his state

-

01

Top Connecticut Dem Jim Himes admits GOP SALT increase would ‘be good’ for his state

Top Connecticut Dem Jim Himes admits GOP SALT increase would ‘be good’ for his state

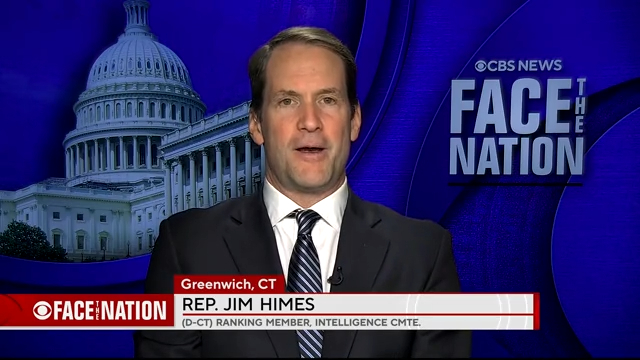

Democratic Representative Jim Himes from Connecticut expressed his approval for the SALT provision in the proposed One Big Beautiful Bill Act during an interview on CBS’ “Face the Nation.” The Act aims to raise the state and local tax deduction cap from $10,000 to $40,000. This change would benefit Himes’ constituents in Connecticut, as the current $10,000 cap disproportionately affects states with high state and local taxes.

The SALT Caucus, represented by Republicans like Mike Lawler and Nick LaLota from New York, had threatened to vote against the bill if the issue was not addressed properly, causing some division within the party. The bill, supported by President Trump, still needs to pass the Senate, where Republican Senator Ron Johnson of Wisconsin has raised concerns about its impact on the deficit.

Himes criticized the GOP megabill for its proposed tax cuts, border security measures, defense funding, energy reforms, and significant spending cuts. He emphasized the importance of tax relief for the middle class and addressing the growing deficit. The bill includes work requirements for Medicaid and SNAP recipients, potentially resulting in millions losing insurance coverage.

House Speaker Mike Johnson defended the bill on “Face the Nation,” highlighting efforts to combat fraud and promote work among beneficiaries. He dismissed worries about the deficit, arguing that the bill would stimulate economic growth. The proposed legislation could increase the deficit by $3.1 trillion over a decade, according to the Committee for a Responsible Federal Budget.