Now Reading: The Rise of Crypto Derivatives in India: How Delta Exchange Plays a Key Role

-

01

The Rise of Crypto Derivatives in India: How Delta Exchange Plays a Key Role

The Rise of Crypto Derivatives in India: How Delta Exchange Plays a Key Role

The crypto market in India is rapidly evolving, with crypto derivatives playing a significant role in this transformation. As the number of crypto traders and their expertise increases, we see futures, options, and perpetual swaps being accessed not only by institutional players but also by retail investors, high-frequency traders, and hedgers.

India’s crypto derivatives sector shows immense potential along with unique challenges. Despite strong market competition and the emergence of numerous exchanges, Delta Exchange stands out due to its product-oriented and compliance-driven approach.

Crypto derivatives are contracts whose value is derived from an underlying crypto asset. Instead of directly buying digital assets like Bitcoin and Ethereum, traders speculate on their price movements through futures, perpetual swaps, and options. These instruments are used for strategies such as hedging, leveraged speculation, and capital efficiency.

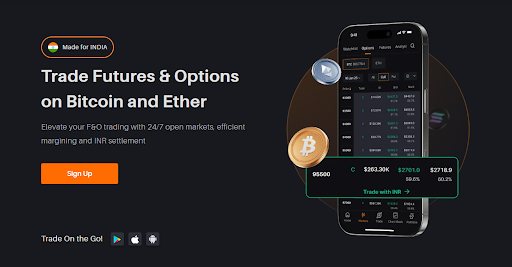

The Indian crypto derivatives market presents opportunities, with digital payment transactions in the country witnessing substantial growth. Delta Exchange offers advantages like trading in INR, regulatory compliance, advanced trading tools, and enhanced financial inclusion for the youth.

While the future holds promise, the Indian crypto derivatives market faces challenges such as regulatory uncertainty, risks associated with high leverage, banking infrastructure limitations, and global competition from established players like Binance and OKX.

Delta Exchange is shaping the future of the crypto derivatives market by prioritizing compliance, offering a diverse range of derivatives, facilitating INR-first trading, providing professional-grade infrastructure, ensuring security and transparency, and focusing on education and risk management for traders.

Trends to watch in the Indian crypto derivatives market include the popularity of structured products and custom strategies, the possibility of regulated crypto ETFs, integration of AI-driven trading pools, increased institutional participation, and the expansion of offerings by Delta Exchange.

In conclusion, the future of crypto derivatives in India looks promising, with a growing need for platforms that offer innovation, accessibility, and regulatory alignment. Delta Exchange emerges as a trusted platform for those looking to explore the world of crypto derivatives with a focus on safety, sophistication, and support.