Now Reading: Sea Lion runs into setback as financing delays Falkland Islands’ $1.4B oil project

-

01

Sea Lion runs into setback as financing delays Falkland Islands’ $1.4B oil project

Sea Lion runs into setback as financing delays Falkland Islands’ $1.4B oil project

Sea Lion oil project in Falkland Islands faces delay in financing, pushing FID to second half of 2025

May 30, 2025, by Melisa Cavcic

Navitas Petroleum from Israel has postponed the final investment decision (FID) for the Sea Lion oil project in the North Falkland Basin (NFB) to the latter part of the year for Phase 1 due to the need to establish a financing plan.

The decision on investing in the Sea Lion oil project in the North Falkland Basin (NFB) was moved to 2025 last year after costs rose to $1.4 billion for Phase 1. Navitas, in partnership with Rockhopper Exploration, has secured a lead technical and lending bank mandate, with the financing plan now involving senior bank debt.

Despite receiving positive initial feedback from potential capital providers, the timing for the FID has shifted, and it is now anticipated in the second half of 2025 to allow the bank to finish its due diligence.

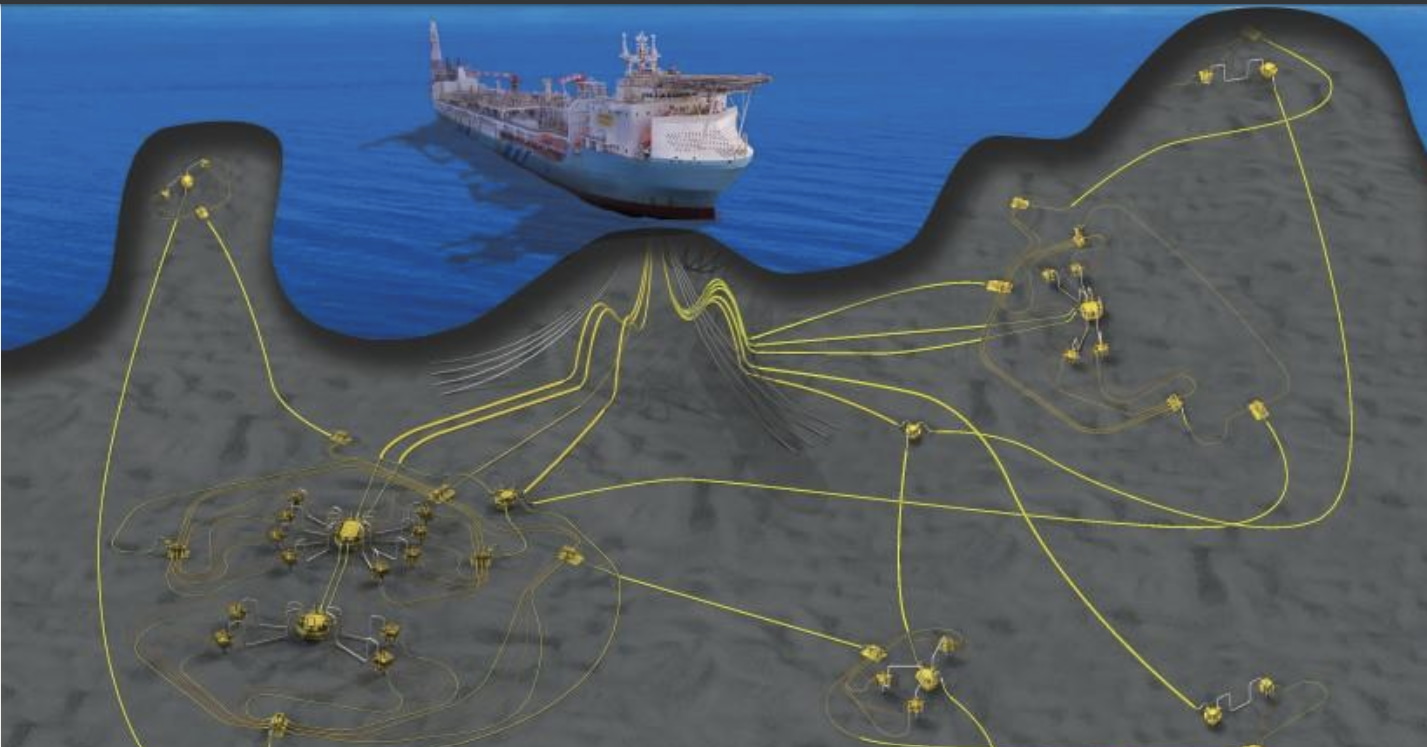

The Sea Lion field, located about 220 kilometers north of the Falkland Islands in Block 14/10, encompasses the proposed developments of phases 1 and 2, which are planned to be executed through a single floating production, storage, and offloading (FPSO) with two drilling campaigns.

Following the update of the project’s field development plan (FDP) to include an initial development stage targeting 312 million barrels of oil (mmbbls), the FDP was submitted for approval. The certified gross 2C resources in the broader North Falkland Basin increased from 712 mmbbls to 791 mmbbls.

The Northern Area phases 1 and 2 will use a redeployed and upgraded FPSO that is expected to be secured upon FID, while the Northern Area Phase 3 and the Central Area phases 1 and 2 will require a significantly larger replacement FPSO to be identified and secured.

Sam Moody, Chief Executive of Rockhopper Exploration, stated: “We are collaborating with operator Navitas to progress the Sea Lion project towards FID. As work on financing for the development gains momentum and technical advancements continue, we anticipate providing the market with further updates.”

Navitas Petroleum, viewing Sea Lion as a significant opportunity, operates the project with a 65% working interest, while Rockhopper holds the remaining 35% stake. Additional potential, including the Isobel-Elaine oil field discovered south of Sea Lion, has been identified and could be developed in future phases.