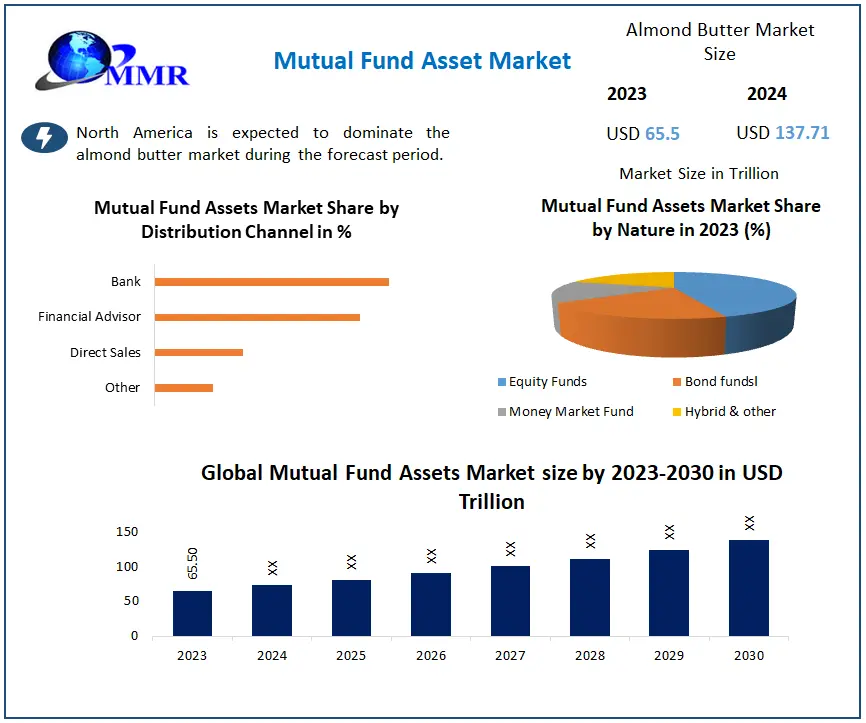

Now Reading: Global Mutual Fund Assets Market to Reach $137.71 Trillion by 2030, Driven by Digital Transformation and Investor Diversification

-

01

Global Mutual Fund Assets Market to Reach $137.71 Trillion by 2030, Driven by Digital Transformation and Investor Diversification

Global Mutual Fund Assets Market to Reach $137.71 Trillion by 2030, Driven by Digital Transformation and Investor Diversification

The global mutual fund assets market is expected to experience significant growth, expanding from USD 65.5 trillion in 2023 to around USD 137.71 trillion by 2030. This growth, which represents a compound annual growth rate (CAGR) of 11.2% during the forecast period from 2024 to 2030, indicates increasing investor confidence, widespread digital adoption in the financial industry, and a rising demand for diversified investment options.

Mutual fund assets encompass the total value of securities held within mutual funds. These funds pool money from various investors and invest in a diversified portfolio of stocks, bonds, money market instruments, and other securities. Managed by professional fund managers, mutual funds offer benefits such as diversification, expertise, liquidity, and access to various markets.

Mutual funds cater to both retail and institutional investors, providing a simplified and cost-effective way to participate in capital markets. Investors select funds based on their objectives, risk tolerance, and investment horizon, making mutual funds a crucial component of personal and institutional wealth management.

The growth of the mutual fund assets market is driven by factors such as digital transformation, increasing financial awareness, the need for diversification, favorable regulatory support, and the emergence of ESG and thematic funds. The market is segmented based on fund type, investor type, and distribution channel.

In the United States, which is the largest mutual fund market globally, there has been a shift towards passive investment strategies like index funds and ETFs. In Germany, a key player in Europe’s mutual fund landscape, investors prioritize stability and favor conservative strategies such as bond funds.

Key players in the competitive landscape of the mutual fund assets market include BlackRock Inc., Vanguard Group, Fidelity Investments, State Street Global Advisors, and Allianz Global Investors. These institutions differentiate themselves through investment strategy, fees, distribution reach, ESG compliance, and digital customer engagement.

The mutual fund assets market is evolving rapidly, driven by growing investor interest in transparent, diversified, and goal-oriented investment products. Technology, changing investor preferences, and the demand for sustainable finance are shaping the future of this market, making mutual funds a vital tool for global wealth creation.