Now Reading: Fears of inflation didn’t materialize in April, but all eyes will be on the May report

-

01

Fears of inflation didn’t materialize in April, but all eyes will be on the May report

Fears of inflation didn’t materialize in April, but all eyes will be on the May report

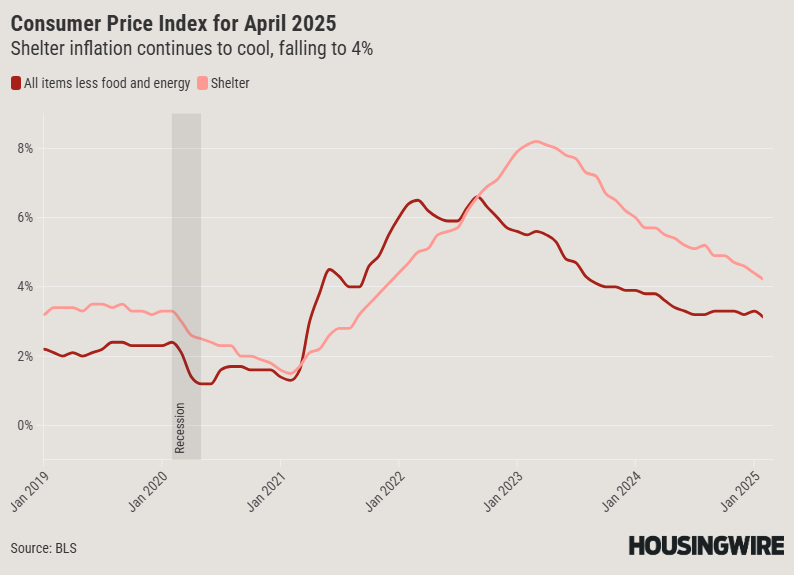

In April, fears that President Donald Trump’s new global tariff regime would cause a spike in inflation did not come to fruition, as reported by the U.S. Bureau of Labor Statistics’ Consumer Price Index (CPI). The data shows a 2.3% year-over-year increase in inflation, up by 0.2% from March, marking the lowest annual rise since February 2021.

Economists predicted this trend in the index, although uncertainties persist due to Trump’s inconsistent tariff policies, which may still lead to inflationary pressures in the future. The lack of clarity in trade policy is likely to cause the Federal Reserve to adopt a cautious approach towards interest rate adjustments.

Despite a slight uptick in inflation, there is still significant economic uncertainty, according to Jake Krimmel, Senior Economist at Realtor.com. The impact of trade policies on inflation, consumer sentiment, and job growth has clouded the outlook for Fed rate cuts and mortgage rates. Until borrowing costs decrease substantially, housing market activity is expected to remain subdued, even as demand and supply gradually improve.

The CPI data indicates a continued acceleration in shelter costs, with housing prices rising by 4% over the past year and a monthly increase of 0.3%. Rent increased by 0.3% compared to the previous month, while the owner’s equivalent of rent saw a 0.4% jump.

There is anticipation around the upcoming May CPI report, especially considering Trump’s recent tariff actions. Although the initial tariff threats were severe, the actual implementation has been scaled back, with a 10% baseline tariff remaining for most countries. The U.S.-China tariff conflict has also eased, with the U.S. reducing its tariffs on Chinese goods from 145% to 30% for a 90-day period.