Now Reading: Do private listings sell for less than those publicly marketed?

-

01

Do private listings sell for less than those publicly marketed?

Do private listings sell for less than those publicly marketed?

In the ongoing discussion surrounding NAR’s Clear Cooperation Policy, a notable question arises: who truly benefits when a single agent or brokerage oversees both sides of a real estate deal? Numerous private listings have turned into dual-ended agreements.

Advocates of exclusive listings argue that consumers experience a more efficient process and heightened privacy. They highlight initiatives like Compass Private Exclusives, enabling sellers to showcase their homes within an internal network before public listing. Nevertheless, Compass itself acknowledges in its disclosure that restricting exposure by avoiding MLS listing may lead to fewer showings, offers, and a lower final sale price.

On the contrary, critics argue that exclusive listings, particularly on a large scale, create an unequal playing field. They assert that private networks disproportionately favor the brokerages and agents controlling the listing pipeline, giving major firms an advantage in agent recruitment and retention. Many also note that private listings exclude lower-income buyers reliant on open MLS access, resulting in reduced market visibility and opportunity that contradicts fair housing principles.

Furthermore, critics suggest that dual-ended deals, often seen in these exclusive environments, could lead to lower sale prices for sellers. Some view this strategy as a means for firms to maximize control while potentially limiting benefits for consumers. Recent data sheds light on these claims and reveals surprising results.

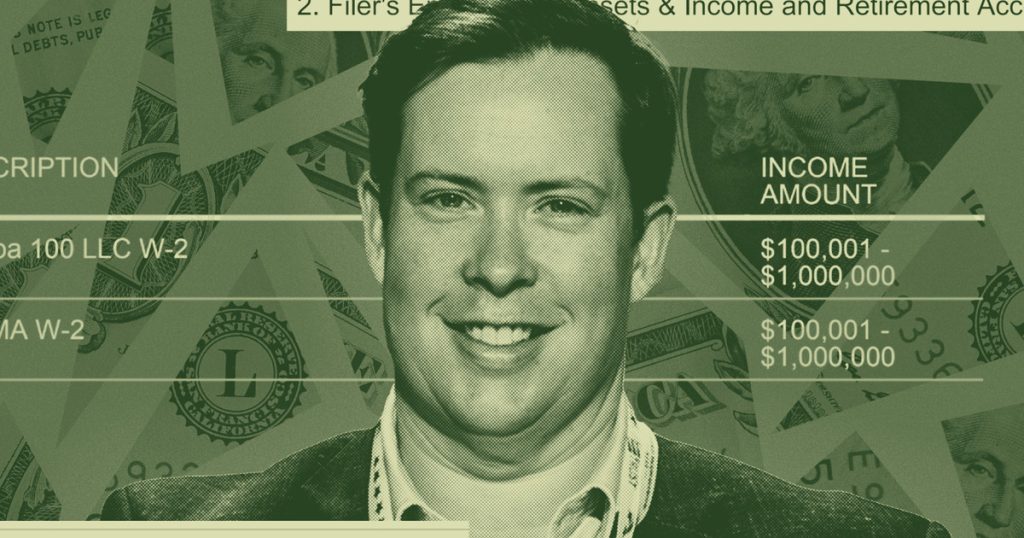

Analysis of thousands of transactions from 2018 to 2024 across major firms uncovers a key trend: on average, dual-ended deals underperform compared to non-dual-ended deals. Dual-ended deals typically sold for 6.36% over the list price, while non-dual-ended deals went for 8.06% over. Though the difference may seem minor, it signifies a 21% lower price performance for consumers when using the same agent for both sides. In most cases, dual-ended deals fetched lower prices than their non-dual-ended counterparts.

The data also indicates that firms engaging in both sides of transactions more frequently are likely to yield below-market results. Firms with consistently high double-ending rates experienced a wider performance gap.

In specific markets and years, a prominent firm displayed a significantly higher share of dual-ended deals, surpassing the average among the top 10 brokerages analyzed. Despite its size, this firm’s dual-ended deals underperformed non-dual-ended deals in nearly every year. Even during competitive markets like 2021 and 2022, dual-ended transactions showed limited gains.

The concentration of listing control in certain firms gives them an advantage in facilitating in-house transactions and internal matchmaking. However, high double-ending rates were found to correlate with weaker results for sellers, with deals often closing near or below the list price, especially in firms with substantial listing control.

As the industry contemplates the future of Clear Cooperation, the data raises a crucial question: if dual-ended deals, more prevalent in exclusive listing environments, consistently lead to lower sale prices, are consumers truly being served?

Moving forward, while a more private process may appeal to some clients, it should not come at the expense of market outcomes. Broad access and transparency remain essential to a fair marketplace. Despite imperfections in any policy, open competition consistently produces better results than controlled exclusivity.

Amidst discussions concerning Clear Cooperation, it is evident that optimal outcomes stem from an open market where every buyer has an equal opportunity.