Now Reading: Beginner Guide For Crypto Trading Strategies

-

01

Beginner Guide For Crypto Trading Strategies

Beginner Guide For Crypto Trading Strategies

Beginner-Friendly Cryptocurrency Trading Strategies

Category: Cryptocurrency | Type: Educational

Trading cryptocurrencies can be a powerful way to grow your wealth, but it also comes with risk. Market volatility and constant innovation can move prices quickly. That’s why it’s essential to use the right buy/sell strategies for digital assets. In this guide, you’ll learn the main crypto trading strategies and how to choose the ones that fit you.

Core Crypto Trading Strategies

The crypto market is unpredictable because it’s influenced by many factors: supply and demand, technological breakthroughs, government regulation, and media sentiment. To reduce the impact of these swings, traders use structured methods—crypto trading strategies—which are rules and techniques for buying and selling on exchanges.

Among the many approaches, beginners and experienced traders alike most often use:

- Scalping

- Day Trading

- Swing Trading

- Long-Term Holding (HODLing)

- Arbitrage

- Dollar-Cost Averaging (DCA)

All of these rely on identifying market trends. Traders monitor the market and use technical indicators—such as trend lines and the Relative Strength Index (RSI)—to forecast moves. When price direction is identified correctly, traders can profit from differences between entry and exit over a period of time.

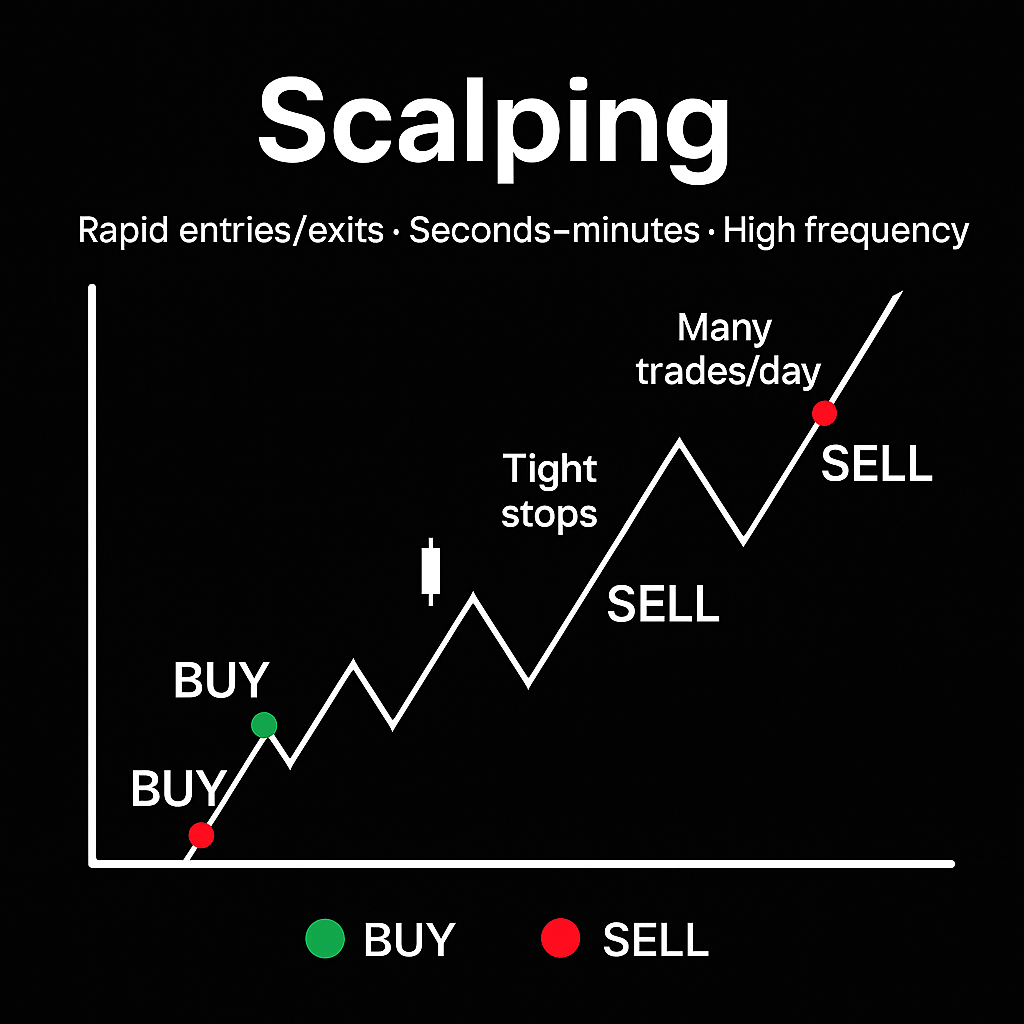

Scalping Strategy

Scalping is a high-frequency approach that aims to capture very small price moves over very short time frames (minutes or even seconds). Scalpers often place dozens of trades per day. This method requires strong technical analysis skills and fast decision-making.

Example: A scalper trades Bitcoin while it oscillates between $90,000 and $90,010. After noticing that each dip quickly snaps back, they buy 1 BTC at $90,000 and sell at $90,010, netting a $10 gain. Repeating this many times a day can create steady, small profits.

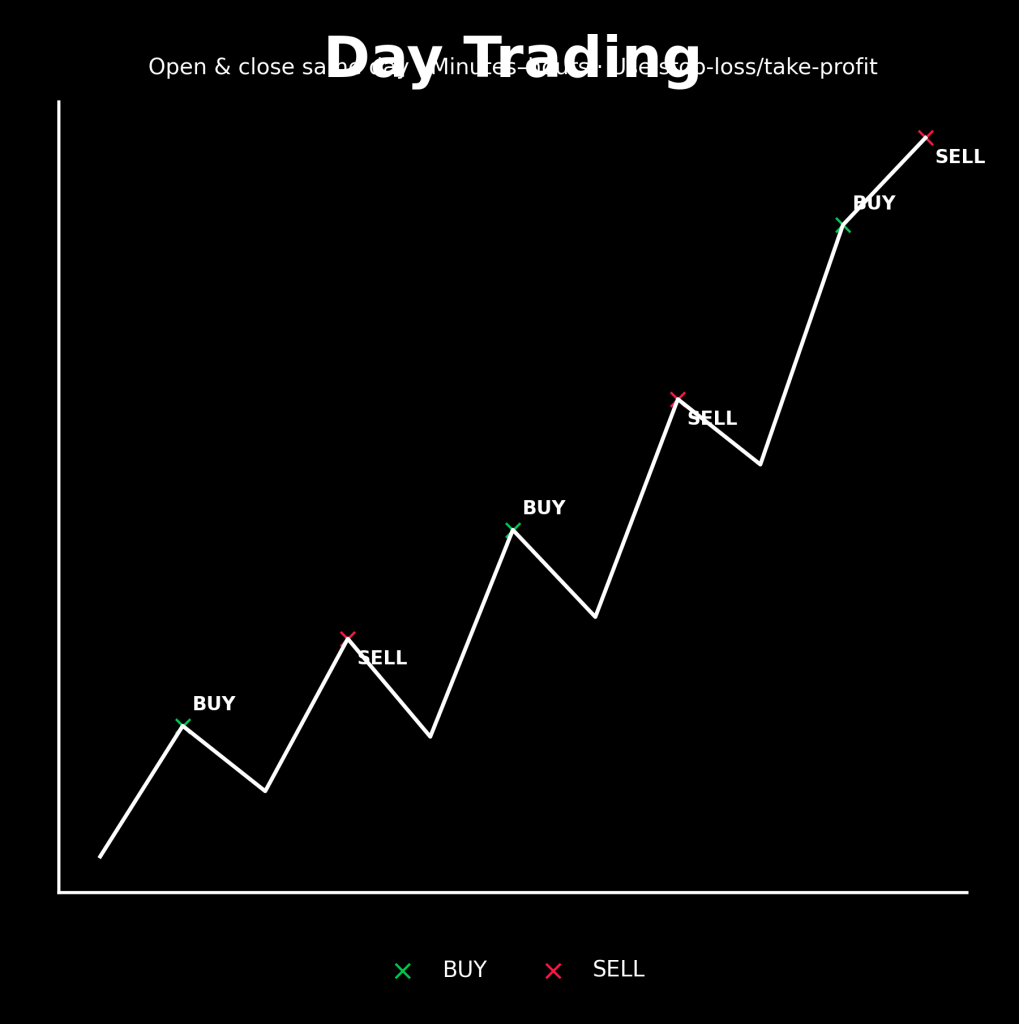

Day Trading Strategy

Day Trading means opening and closing positions within the same day to benefit from short-term price moves. Traders rely on technical analysis to read trends, often using stop-loss orders to limit risk.

Example: A day trader watches Ethereum (ETH). In the morning, ETH trades at $3,000. Based on RSI and chart signals indicating a bullish trend, the trader buys. A few hours later, ETH reaches $3,200; the trader sells and realizes a $200 profit per ETH.

If you want to try day trading, consider using an exchange with real-time charts, strong liquidity, fast order execution, a wide selection of trading pairs, and low fees. These features help you make informed decisions and execute quickly.

Swing Trading Strategy

Swing Trading targets price moves that play out over several days or weeks. Traders buy during bearish pullbacks and sell into bullish rises, using technical tools (including RSI) to anticipate reversals and continuations.

Example: A trader monitors Bitcoin after a long downtrend that has recently started to turn up. When price pulls back from $90,000 to $85,000 and RSI shows momentum recovering, the trader buys 1 BTC at $85,000 and sells a few days later at $90,000, capturing a $5,000 gain.

Long-Term Holding (HODLing)

HODLing is a long-term approach: buy and hold despite short-term volatility. The thesis is that, over time, the asset’s value will grow substantially, even if the path is choppy.

Example: An investor buys ETH at $3,000. Over the following months, price fluctuates between $2,500 and $3,500. The investor maintains conviction and holds. Years later, if ETH rises to $10,000, selling then would lock in significant profits.

Arbitrage Strategy

Arbitrage profits from price differences for the same coin across multiple exchanges. A trader buys on the platform with the lower price and sells on the one with the higher price. These opportunities are usually short-lived, so speed is crucial.

Example: Bitcoin trades at $89,500 on Exchange A and $89,510 on Exchange B. The trader buys on A and immediately sells on B, pocketing a $10 spread (before fees and slippage).

Dollar-Cost Averaging (DCA)

DCA is a long-term method where you invest a fixed dollar amount at regular intervals regardless of price. This simplifies decision-making and helps smooth out volatility by averaging your entry price over time.

Example: A trader invests $500 into ETH on the same day each month for six months. If ETH is $3,000 in month one, they buy about 0.1667 ETH. If ETH drops to $2,500 in month two, they buy about 0.20 ETH. By month six, they’ve accumulated ETH at an average price, reducing the impact of short-term swings.

How to Choose the Best Strategy for You

- Clarify your goals. Are you seeking short-term gains or long-term growth? Your objective will guide your strategy choice.

- Start small. In the beginning, consider simpler approaches and longer holding periods. As you gain skill, you can analyze faster and explore shorter-term methods.

- Manage risk. Trade only with money you can afford to lose, and use stop-loss orders to protect against large drawdowns.

- Stay informed. Follow crypto news and market updates to understand trends and context. Educational blogs and research can help you refine your approach.

By following these guidelines, you can trade more effectively. If you find decision-making difficult, consider consulting a crypto specialist or financial advisor.

Final Thoughts

We hope this guide clarifies the most common crypto trading strategies so you can make informed choices. Still have questions? Drop them in the comments!

Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves significant risk, including the possible loss of principal. Always do your own research and consider professional advice before making investment decisions.