Now Reading: Here’s how far homebuilder stocks have fallen since ‘Liberation Day’

-

01

Here’s how far homebuilder stocks have fallen since ‘Liberation Day’

Here’s how far homebuilder stocks have fallen since ‘Liberation Day’

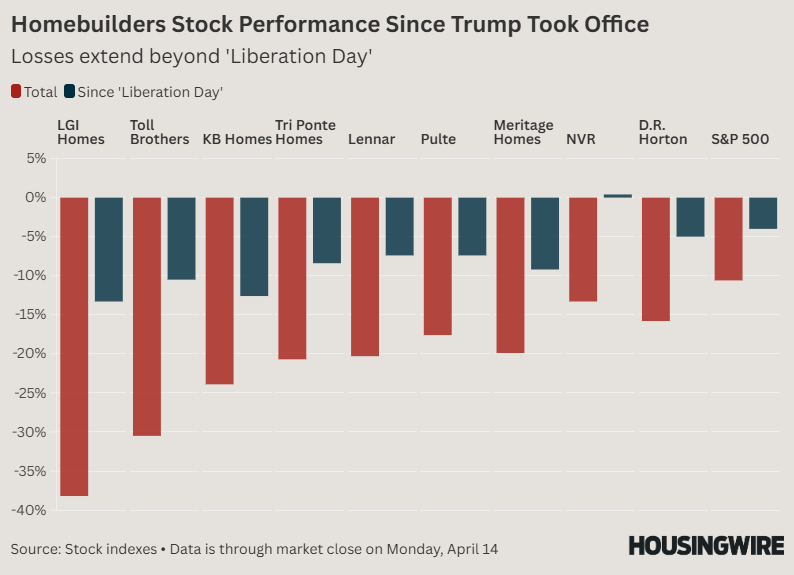

Donald Trump’s second term has been challenging for homebuilders. The impact of the president’s global tariff policies on construction material imports, combined with labor shortages generated by his efforts to curb illegal immigration, has hit the industry hard. Homebuilder stocks have reacted sharply to Trump’s tariff threats, resulting in significant losses compared to the broader market indices like the S&P 500.

Since Trump took office, the S&P Homebuilders Select Industry Index (SPHSII) and major homebuilder stocks have experienced more pronounced declines than the S&P 500. Following Trump’s announcement of new global tariffs on April 2, labeled “Liberation Day,” markets were sent into turmoil. While Trump has shown a commitment to tariffs, the fallout from the April 2 announcement led to a temporary pause on the levies, which will expire after 90 days.

China, a key player in U.S. construction material imports, was notably excluded from the tariff pause, with Trump imposing consecutive 10% tariffs on Chinese goods. The National Association of Home Builders (NAHB) reports that China represents a significant portion of U.S. construction material imports. The tariffs are expected to raise home construction costs significantly, as estimated in a study by John Burns Research & Consulting conducted before April 2.

In addition to the global tariffs, homebuilders are also grappling with a 25% tariff on steel and aluminum imports, along with potential tariffs on lumber imports threatened by the president.