Now Reading: Delicate balancing act for Senate on reconciliation tax package

-

01

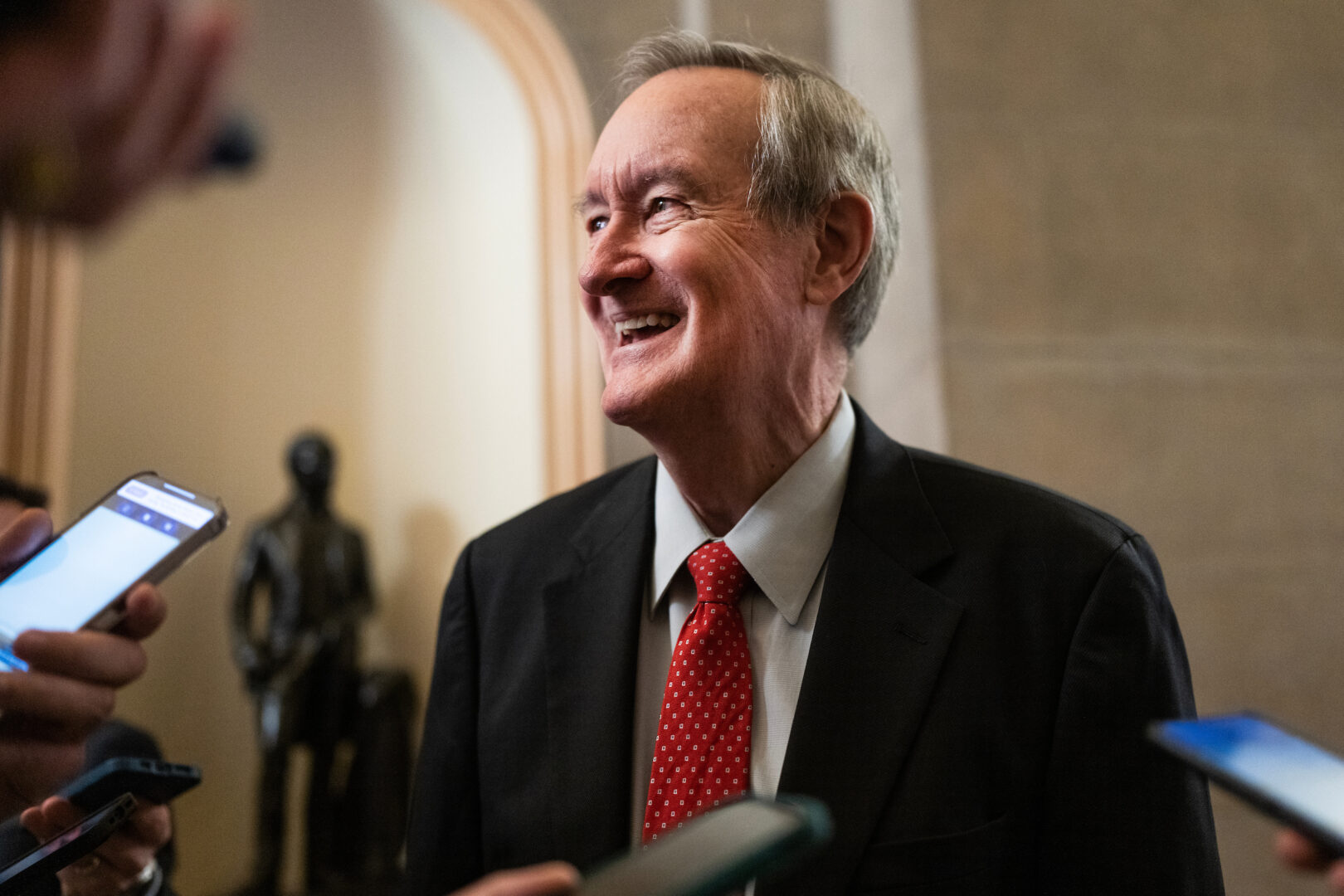

Delicate balancing act for Senate on reconciliation tax package

Delicate balancing act for Senate on reconciliation tax package

The Senate is gearing up to make changes to the House’s nearly $4 trillion tax package as lawmakers return to Washington this week. While the extent of the alterations is not yet clear, there are numerous opportunities for adjustments to cater to the needs of lawmakers and interest groups.

Under the budget resolution, Senate Republicans have more flexibility in terms of tax allowances, potentially allowing for a tax bill exceeding $5 trillion. However, whatever the Senate passes will still need to be sent back to the House for approval.

House fiscal conservatives have expressed opposition to any bill that increases tax cuts beyond the current level without corresponding spending cuts. Meanwhile, Republican members of the Finance Committee are pushing for permanent business tax breaks, such as deductions for research and development investments and full expensing of machinery and equipment purchases.

Interest groups are looking to influence the Senate’s tax package to include their favored policies and soften or remove provisions that could impact them negatively. Lobbyists are targeting provisions like increased excise taxes on endowment investment returns and retaliatory taxes on foreign entities.

Foreign multinationals with business in the U.S. are urging senators to reconsider certain provisions in the House bill that could discourage investment. Additionally, there are discussions about making tax breaks for income earned abroad more generous and reevaluating the state and local tax deduction cap.

Overall, Senate Republicans are expected to make minor changes to the tax package, in collaboration with House Republicans, to maintain a delicate balance in the final legislation.