Now Reading: 6 charts that show storm clouds brewing over the spring homebuying season

-

01

6 charts that show storm clouds brewing over the spring homebuying season

6 charts that show storm clouds brewing over the spring homebuying season

As the spring buying season approaches, the housing market is encountering significant uncertainty and volatility. Recent reports and data suggest that the effects are becoming evident.

Homebuilders D.R. Horton and KB Homes conducted earnings calls this week, with disappointing outcomes. In the first quarter of 2025, KB Homes faced a $334 million cash loss from operations. D.R. Horton saw a 15% decrease in net sales orders and a 15.2% drop in home sales revenue.

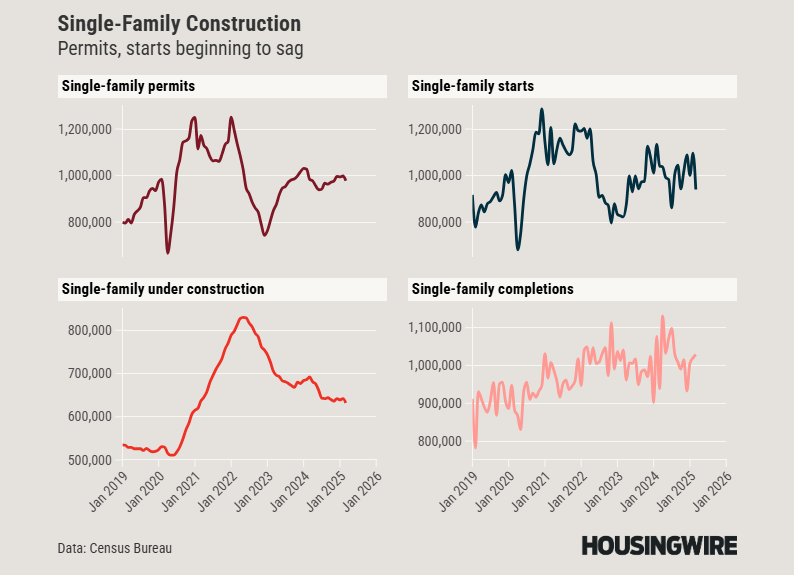

The U.S. Census Bureau’s March new construction report mirrored these challenges. Single-family permits decreased by 2% compared to February, while single-family starts experienced a significant 14.2% decline, the largest monthly drop since April 2020.

Builders are acknowledging the obstacles ahead. The National Association of Home Builders (NAHB) /Wells Fargo Housing Market Index for April stood at 40, one point higher than March, but still considered pessimistic below 50. Material costs have escalated by an average of 6.3% this year, with 60% of builders reporting an increase of $10,900 in constructing a single-family home.

President Donald Trump’s tariff actions have added to the challenges. The fluctuating tariff situation has unsettled various industries, including construction. The ongoing trade tensions between the U.S. and China have raised the effective tariff rate on Chinese imports to a staggering 147.5%.

The housing market is also affected by consumer sentiment. A survey revealed that 55% of Americans are less likely to make significant purchases due to tariff policies. The University of Michigan’s Consumer Sentiment Index for April dropped by over six points, primarily due to inflation expectations.

While new construction and demand are declining, there is optimism among home sellers. A Realtor.com survey indicated that 70% of potential sellers believe it’s a good time to sell. However, there is a rush in the market as buyers and sellers aim to navigate potential volatility and policy changes.

Moreover, mortgage rates have fluctuated, with a notable increase in the rate on a 30-year fixed mortgage shortly after April 2. The housing market, once expected to be strong, faces uncertainties from various factors, painting a challenging picture for the upcoming months.